My mother-in-law is not the richest person in the world – to be honest, she earns less than the average salary in the country. But if you put together all the money she spent on various small toys and sweets for her three grandkids, you could… no, not buy a new car, but definitely the newest model of PlayStation. For each of them.

Well, that’s what many grandparents actually do. But not all of them. And this video from the TikToker @tammie_time_, which we’ll tell you about today, is further proof of this. This grandma prefers strategic thinking when it comes to gifts for her grandchildren.

This grandma wanted to share her ‘unpopular opinion’ regarding gifts for grandchildren

Image credits: tammie_time_

The author of the video has 4 grandkids and they love to get gifts, like literally any kid

In fact, everything is quite simple. The Original Poster (OP) has four grandchildren, the oldest of whom is 9 years old, and the youngest is 8 months old. And while many grandmothers literally shower their sweet grandkids with various small gifts almost at every meeting, our heroine decided to do something fundamentally different.

Image credits: tammie_time_

The grandma reasoned that the tots already receive a lot of gifts from parents and relatives, and these little things sooner or later get broken and end up in the trash. All these little figurines, dolls, cars, Legos and whatnot. The OP has already experienced this with her own children.

Image credits: Ivan Samkov / Pexels (not the actual photo)

The grandma decided to invest the ‘gift’ money into the kids’ accounts for the future

Instead, the woman decided to put aside all the money that she could spend on gifts for the future. For example, for her grandchildren’s education when they come of age, or for a down payment on their future house. No, on big holidays, like Christmas or birthdays, she, of course, gives gifts – but nothing more.

Image credits: freepik / Freepik (not the actual photo)

The woman started with various plans so that her grandkids will have a decent amount of money after coming of age

The grandma initially decided to start with a 529 plan, but then reasoned that it’s not necessary to graduate from college to become a decent person – so she began to invest the money in other plans. This way, when the children grow up, they will already have a hefty amount of money waiting for them, which will be like a real treasure for them.

The woman agrees that this decision is clearly not the most popular opinion, and that many people will probably criticize it. But she still thinks it makes sense to share her point of view with other parents and grandparents. Maybe someone will use this experience in their own family…

You can watch the original video here

Let’s now do some math. According to this grandma herself, immediately after the birth of each of her grandkids, she put $100 into their account, and adds $10 every week. Thus, by the age of 18, even without taking into account interest, this will be about $9.5K.

At the same time, the average cost of college in the United States is $38,270 per student per year, according to Education Data. This also includes books, supplies, and daily living expenses. Yes, inflation also matters but anyway, as you can see, even small deposits can significantly help children with education. Moreover, Education Data states that 30% of American families nowadays use a college savings fund to save an average of $7,806 each.

In other words, purely mathematically, the grandma makes a good investment for her children. And even if they don’t want to go to college, the accumulated amount can also be invested in order to receive a down payment for their own home in a couple of years. So, the original poster states that she lives in Ohio, and the average down payment in this state, according to Voronoi App, is $15K. Of course, there may be minor errors, but these are details.

Image credits: freepik / Freepik (not the actual photo)

Well, considering how expensive education and housing are nowadays, this point of view does seem completely reasonable. On the other hand, there is the problem of inflation, because not all such plans are really protected from serious devaluation of money.

For example, when I was a toddler myself, my grandma put money in the bank in my account – only for it to turn into practically dust in the wind two decades later. It would probably have been better if she had bought me a gaming console… In any case, the kids may also be upset and even offended that all their other relatives give them gifts, but grandma does not.

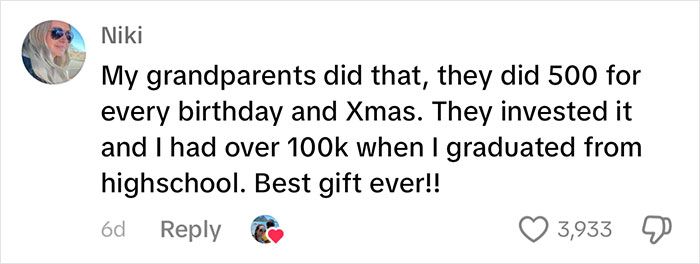

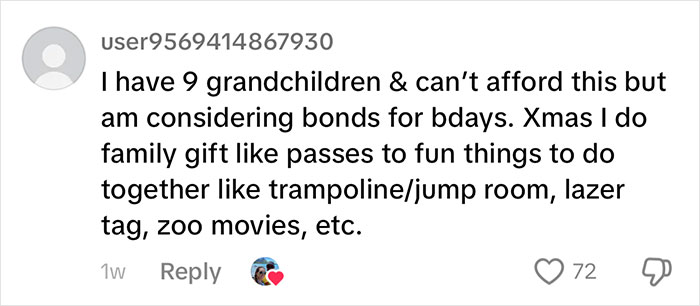

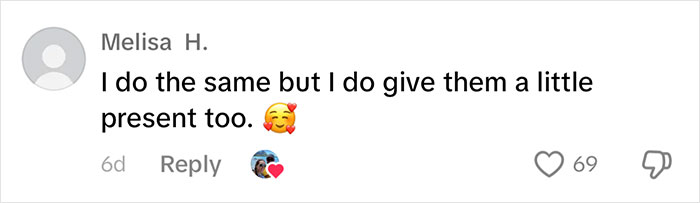

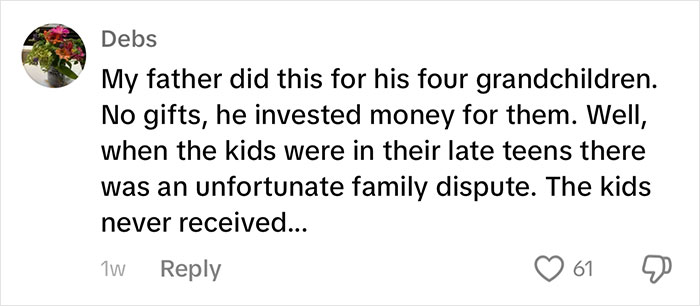

Well, the original poster foresaw a wave of criticism in the comments – and that’s just what happened. Many people actually wrote that such a decision can negatively affect the children’s attitude towards their grandma. “So u hate your grandkids, cool,” someone even wrote in the comments under the video.

However, there were way more positive and laudatory comments. “What a wonderful gift for their future. I totally agree with your thinking,” someone gave the OP a shoutout. “I wish my MIL did this. She wasted so much money on things that get tossed,” another responder added. “It’s maddening mostly because she can’t afford it.” And what do you, our dear readers, think about this grandma’s decision?

The commenters were very divided, but most of them praised the grandma for this decision, calling it wise and reasonable

Well, considering how expensive education and housing are nowadays, I think this grandma’s strategic approach is pure genius. Sure, some might call her approach “unpopular,” but in a world where inflation can turn money into Monopoly tokens overnight, maybe we need more people like her. What a way to future-proof love, right?