Shocking Revelation

Many people are feeling the pinch of rising living costs, but what if I told you that a couple earning $200,000 a year is living paycheck to paycheck? It may sound unbelievable, but it’s true. Despite their hefty income, this couple’s spending has spiraled out of control, leaving them in a dire financial situation.

The Curse of Lifestyle Creep

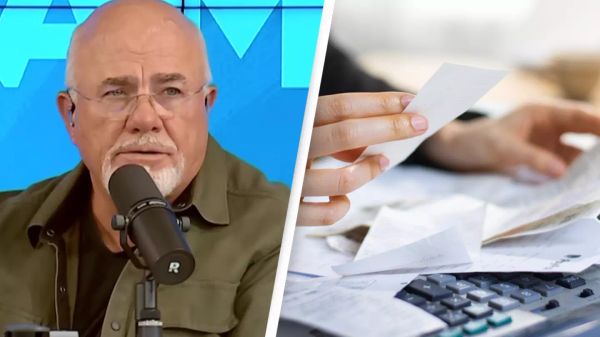

Financial advisor Dave Ramsey, who had the opportunity to speak to this couple on his podcast, was shocked by their financial predicament. He attributed their situation to something called “lifestyle creep.” Lifestyle creep happens when people ramp up their spending faster than their income grows. This couple fell victim to this phenomenon, and now they are paying the price.

Drowning in Debt

The numbers don’t lie. This couple is swimming in a sea of debt, with a staggering $800,000 in liabilities. It’s no wonder they find themselves living paycheck to paycheck. Despite both of them working, earning a base salary of $175,000 and generating an additional $20,000 from rental properties, their financial situation is dire. Even residing in a relatively affordable Midwest city like Des Moines, Iowa, hasn’t been enough to save them from this financial quagmire.

The Dilemma of Letting Go

One solution they are considering is selling their rental property, which is worth a tidy sum of $325,000. However, the emotional attachment and resistance to the idea from one spouse makes this decision a difficult one. This reluctance to let go and disbelief in living life debt-free is hindering their path to financial freedom.

A Wake-Up Call

Upon reviewing their situation, Dave Ramsey had some harsh words for this couple. “You guys are seriously broke!” he declared. With a mix of mortgage debt, personal loans, car loans, student loans, and credit card debt, their financial hole seems to be getting deeper and deeper. Ramsey emphasized the need for change, stating, “You can’t live like this. This is ridiculous. You’re working your butt off and going backwards.”

The Power of Not Caring

Ramsey also advised against succumbing to the pressure of keeping up appearances. He encouraged the couple to embrace the superpower of not caring what others think. In these tough financial times, it’s crucial to prioritize financial stability over appearances.

In conclusion, this story serves as a reminder that financial struggles can affect anyone, regardless of their income. It’s essential to be mindful of our spending habits and avoid falling into the trap of lifestyle creep. By making conscious choices and prioritizing financial well-being, we can strive for a more secure and less stressful future.