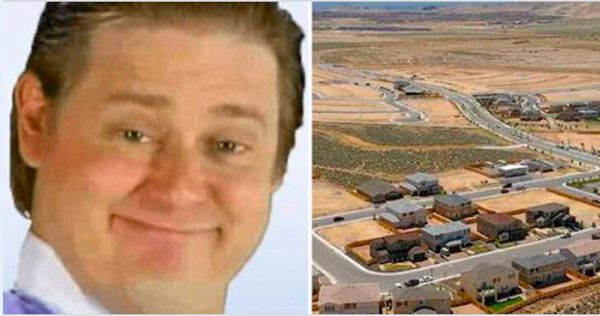

Buying a home can be a stressful and expensive process. However, one lucky homebuyer in Nevada managed to secure an incredible deal. While intending to purchase a single-family home, she ended up acquiring not just that property, but an additional 84 house lots and two extra parcels in Toll Brothers’ Stonebrook development. The total value of all these properties was worth millions of dollars.

This extraordinary situation occurred due to a simple copy-paste error made by Westminster Title, the company handling the transaction. They accidentally included the legal description of the other properties in the homebuyer’s deed. Once the error was discovered, the Washoe County Assessor’s Office promptly informed Toll Brothers about the issue.

Cori Burke, the chief deputy assessor for Washoe County, explained that errors like this, although uncommon, do occur. They often arise from copy-paste mistakes in legal descriptions. In this case, the mistake was particularly notable due to the significant number of properties involved. To rectify the situation, the homebuyer will need to transfer the title back to Toll Brothers, who can then proceed with transferring the ownership to other buyers through the usual process.

Despite the potential for complications, Burke believes that the homebuyer’s clear intent, as evidenced by the offer and acceptance documents, would prevent any legal issues. The title company, Westminster Title, recorded a new document on August 9, 2022, to return the true and rightful ownership of the properties to Toll Brothers. The Washoe County Assessor’s Office has updated the ownership information accordingly.

While this extraordinary case may seem like a dream come true for the homebuyer, it highlights the challenges faced by many prospective homeowners in today’s market. According to Mark Zandi, the chief economist at Moody’s Analytics, rising mortgage rates and soaring house prices have made it increasingly difficult for first-time homebuyers to enter the market. The median listing price for single-family homes in the United States has surged, making affordability a significant concern.

As a result, mortgage applications have dropped to the lowest level in 22 years. While some experts advise prospective buyers to wait for the market to improve, the uncertainty surrounding future conditions makes it a challenging decision. Rachel Luna, the principal of Patriot Title in Houston, advises buyers to prioritize their personal finances and long-term economic stability. It is essential to consider factors such as being debt-free, having an emergency fund, and ensuring the monthly house payment is no more than 25% of take-home pay.

In conclusion, while the Nevada homebuyer’s accidental acquisition of 87 properties may seem like a stroke of luck, it sheds light on the current difficulties faced by homebuyers in the real estate market. Taking the time to address personal finances and make informed decisions can help navigate these challenges successfully.